Cataract surgery is usually covered by insurance when it's "medically necessary." In most cases, this means your insurance and eye doctor agree that a cataract is causing noticeable vision problems, and surgery is the best way to treat it.

Cataract surgery is covered by health (medical) insurance.

Vision insurance does not cover cataract surgery, even though your vision is involved. Instead, it's used to lower the costs of routine eye care like eye exams and prescription glasses or contact lenses.

Surgeries and specialist appointments — like cataract removal and ophthalmologist visits before and after surgery — usually fall under health insurance.

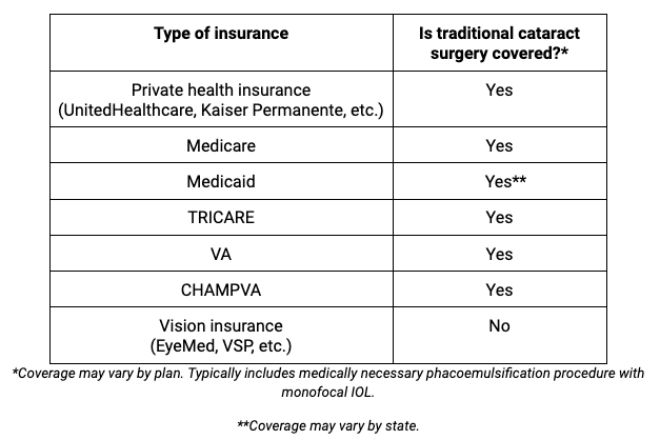

Here's how different kinds of coverage handle the procedure:

Click to enlarge.

If you have private medical insurance, cataract surgery should be covered regardless of whether you have an HMO, PPO or another plan. But different kinds of plans can require different steps.

For example, if you have an HMO, you'll probably need a referral from your primary care physician before you visit an in-network ophthalmologist. That way, you can be sure you're paying the lowest rates for your procedure and exams.

Most health insurance plans cover:

During a basic procedure, the doctor uses ultrasound waves to break the cloudy lens into small pieces and then vacuum them out.

This is called phacoemulsification — the most common type of cataract removal in the United States. Insurance should cover it as long as it's medically necessary.

The doctor might choose a slightly different procedure if your cataracts are severe.

There are often separate charges for doctor fees, facility fees and anesthesia (if you have to be sedated or put to sleep). Check with your doctor's office to ensure they're all covered by your insurance.

The surgeon places an artificial lens (IOL) inside your eye after they remove your cloudy natural lens. In many cases, insurance will fully cover one kind of artificial lens — a monofocal lens.

Monofocal lenses correct your vision at one distance. They're usually set to help you focus on farther objects instead of closer ones. But in some cases, the patient would like the lens focused for near vision. They then wear glasses for distance vision.

You'll need to see your ophthalmologist for a consultation before surgery and several follow-up appointments after surgery.

Many people still have to wear glasses or contact lenses once their eyes adjust to the new IOL, especially when monofocal IOLs are used.

Normally, prescription eyeglasses and contacts fall under vision insurance coverage. But Medicare will cover a pair of standard prescription glasses or contacts after surgery for people enrolled in Plan B.

Most insurance will not fully cover:

There are many kinds of IOLs, but insurance usually only covers monofocal IOLs.

Special, "premium" IOLs can help some people see better without glasses after surgery. Some of them are:

A basic monofocal lens will fix cataract symptoms for most people, so insurance companies usually consider premium lenses optional.

You could have higher out-of-pocket costs if you choose a premium IOL.

Surgeons can use laser cataract surgery to create pinpoint incisions and help break up the cloudy lens before removing it. It can help the doctor treat a severe cataract or place a multifocal IOL more accurately.

Insurance rarely covers this kind of surgery. It can cost a lot more than a traditional procedure, especially if it's paired with a premium lens.

Insurance may cover cataract surgery, but it probably won't pay for all of it. You'll be responsible for any leftover costs after insurance pays their part.

The total cost of cataract surgery could depend on your:

These factors won't apply to every kind of coverage, so it helps to check with your insurance for specific details.

Yes — health savings accounts (HSA) and health care flexible spending accounts (health care FSA or HCFSA) can be great ways to lower your surgery costs, even after insurance is applied.

These accounts let you pay for approved medical expenses with pre-tax money.

Your savings will depend on the total cost of surgery, how much you contributed to the account that year and how much you still have left in the account.

The maximum contribution limits for 2023 are:

Your FSA limit could be lower, depending on your employer.

READ MORE: HSA vs. FSA

Cataract surgery insurance coverage can vary from plan to plan. It never hurts to double-check the details with your doctor's office and insurance beforehand, even when you've been pre-authorized for surgery.

If you haven't been diagnosed with cataracts or haven't found a surgeon, call an eye doctor near you to schedule an appointment.

Vision coverage. HealthCare.gov. Accessed October 2023.

Cataract surgery: Risks, recovery, costs. EyeSmart. American Academy of Ophthalmology. November 2023.

Eyeglasses & contact lenses. Medicare.gov. Accessed October 2023.

Cataract. EyeWiki. American Academy of Ophthalmology. November 2023.

Cataract surgery. National Eye Institute. January 2023.

IOL implants: Lens replacement after cataracts. EyeSmart. American Academy of Ophthalmology. November 2022.

Toric IOLs. EyeWiki. American Academy of Ophthalmology. November 2023.

Deductible. HealthCare.gov. Accessed October 2023.

Coinsurance. HealthCare.gov. Accessed October 2023.

Copayment. HealthCare.gov. Accessed October 2023.

Out-of-pocket maximum/limit. HealthCare.gov. Accessed October 2023.

Allowed amount. HealthCare.gov. Accessed October 2023.

Health savings account (HSA). HealthCare.gov. Accessed October 2023.

2023 health FSA contribution cap rises to $3,050. Society for Human Resource Management. October 2022.

Page published on Monday, April 13, 2020

Page updated on Tuesday, December 12, 2023

Medically reviewed on Tuesday, December 5, 2023