Child custody is one of the most challenging topics for divorced parents to discuss. In especially nasty disputes, a divorcing couple can argue over everything, from custody of a child to financial assets. But for divorcing parents who are looking for mutually beneficial solutions, tax benefits can be a place to start. And that is where IRS Form 8332 comes in. Normally, the custodial parent receives the tax benefits on behalf of their dependent children. But there are times when it might be better for the custodial parent to allow the non-custodial parent to take those tax benefits instead by filing Form 8332.

According to the IRS, a separate Form 8332 is filed for each child. There are three parts to Form 8832:

Regardless of which part or parts are completed by the custodial parent, the non-custodial parent’s name and Social Security number are entered at the top of the form.

Let’s take a look at each part of the form in more detail, beginning with Part I.

The custodial parent completes this part to release their claim to the child exemption for the current tax year. They will sign, date, and attach their SSN at the bottom of Part I.

irs form 8332, part i: release of claim to exemption for current year" width="1630" height="1202" />

irs form 8332, part i: release of claim to exemption for current year" width="1630" height="1202" />

If the custodial parent wants to include future tax years, they must also fill out Part II.

The custodial parent completes this part to release their claim to the child exemption for future tax years.

According to the IRS instructions, the custodial parent may cite specific tax years, or simply state, “all future years.”

irs form 8332, part ii: release of claim to exemption for future years" width="1630" height="1202" />

irs form 8332, part ii: release of claim to exemption for future years" width="1630" height="1202" />

The custodial parent will sign, date, and attach their SSN at the bottom of Part II.

If the custodial parent wishes to relinquish their exemption claim for the current AND future tax years, then that parent would complete Part I and Part II.

If the custodial parent chooses to revoke their previous release of claim, then he or she will complete Part III. As with Part II, the custodial parent can state specific years, or simply write, “all future years.”

However, the revocation will only work for future years, not the current tax year.

For example, Mary, a custodial parent, previously relinquished her exemption for tax years 2018 through 2025. In 2024, Mary decides to file Form 8332 to revoke her previous release. That revocation will take effect for tax year 2025, but not 2024.

In addition to properly completing Form 8332, it’s important to recognize who must file this form with the IRS.

IRS Form 8332 is titled, “Release/Revocation of Release to Claim to Exemption for Child by Custodial Parent.”

According to Section 152(e)(2) of the tax code, the custodial parent can release their claim to any child or dependent related tax exemption with a written declaration. That written declaration must:

So Form 8332 serves as that written declaration. But before we go too much further, we should talk about the difference between the custodial and non-custodial parent.

While IRS Form 8332 might be used to transfer tax benefits between a custodial parent and a noncustodial parent, this form doesn’t apply to everything.

Below are some of the tax benefits that a parent may not transfer by releasing a claim to exemption, and an explanation for each.

According to the tax rules, you do not necessarily have to have a child to claim the earned income tax credit (ETIC). You have to meet the following basic criteria:

You also have to:

There are additional considerations for servicemembers, clergy, and taxpayers with disabilities.

The IRS website states that only the custodial parent can claim the child and dependent care credit by filing IRS Form 2441 with his or her tax return. This credit is not transferrable to the noncustodial parent.

And the custodial parent can only claim the credit if they are claiming on behalf of a qualifying child. To be a qualifying dependent, a child must:

Learn more about Form 2441 and the child and dependent care tax credit in this video.

To qualify as head of household, a taxpayer must:

However, both the custodial and non-custodial parent can claim head of household status, if each person individually qualifies. For example, a non-custodial parent could claim as head of household if that person is responsible for another dependent (like an aging parent).

Generally speaking, the parent who is claiming the exemption for the given tax year will file Form 8332 with their income tax return. It’s best to have this form completed well before tax season starts. That will allow each person’s tax accountant the opportunity to understand the tax impact of their client’s situation.

Of course, it’s a good practice for both parents to keep copies of each signed form with their tax records. That way, if anything comes up, they can discuss it with their tax expert.

This could be something that is determined as part a child support order, other court order, or as part of a support agreement. But that is beyond the scope of this article.

Instead, let’s focus on another question:

When would it make sense for the custodial parent to voluntarily give up their exemption?

Let’s assume that tax efficiency is the goal, for both households. As a general rule, the parent with the higher income should claim the exemption. This will allow them to maximize the tax benefits from the associated tax credits. But not always.

If the parent who would claim the credit earns too much income, then he or she might be subject to a phaseout.

A phaseout is when a tax credit or deduction is gradually reduced in proportion to the income above a certain threshold. Then, after a certain amount, that credit or deduction disappears completely.

The child tax credit phaseout impacts high-earning taxpayers. Specifically, taxpayers whose MAGI exceeds:

Taxpayers who meet this criteria will see their child tax credit reduced by $50 per $1,000 above this threshold until reduced to zero.

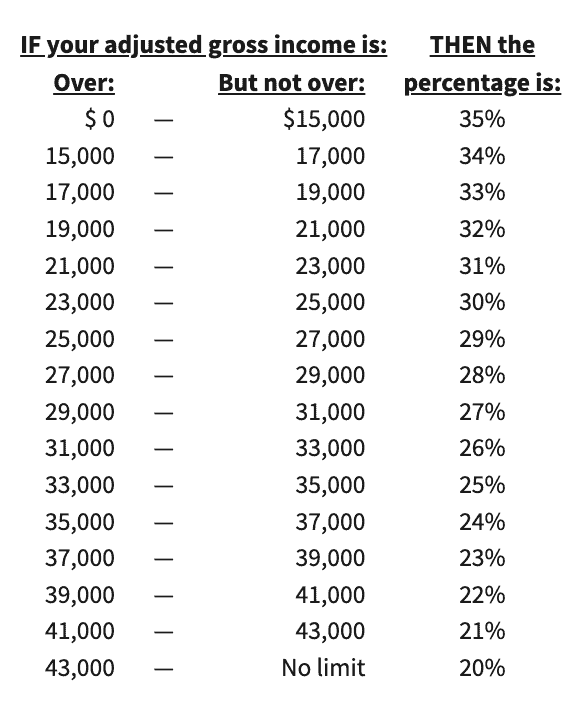

IRS Publication 503, Child and Dependent Care Expenses, discusses the income phaseout for this tax credit. This credit normally assigns a percentage of the costs of care as the tax credit.

Full credit is considered 35% of the cost of expenses, up to a maximum of:

For example, if you spent $4,000 in 2022 for child care, and you received the full benefit of the child care tax credit, then you would receive $1,400, or 35% of the cost of the care.

This phaseout starts at $15,000 (for all taxpayers, except for married couples filing separately), and ends at $43,000. In households with AGI greater than $43,000, the maximum credit is 20% of qualifying expenses, up to the specified dollar limits.

Taxpayers may use IRS Form 8332 to transfer the following tax credits: child tax credit, additional child credit, and the credit for other dependents, if applicable.

What tax benefits cannot be transferred by Form 8332?The following tax benefits cannot be transferred by Form 8332: child and dependent care credit, earned income credit, head of household tax status.

Does the custodial parent have to sign Form 8332?Generally speaking, the parent who is claiming the exemption for the given tax year will file Form 8332 with their income tax return.

If Part 1 or Part 2 are completed, then the non-custodial parent would attach the Form 8332 to their tax return for each year they claim the exemption. If the custodial parent completes Part 3, then the custodial parent would attach the newly completed form to their tax return for each year that they claim the exemption.

For tax purposes, who is the custodial parent?For tax purposes, the custodial parent is the parent with whom the child spent the majority of the year. Specifically, the IRS defines this as the greater number of nights during the taxable year. If the child spent an equal number of nights with each parent, then the custodial parent is the one with the higher adjusted gross income.This might be different from the definition of custody as defined by state law.

As with most tax forms, you can find IRS Form 8332 on the IRS website. For your convenience, we’ve attached the latest version of IRS Form 8332 to this article.